Calculating How Much Do Introducing Brokers Make in the Forex Market

Online revenue generation is now easier than ever. Today, Forex trading offers more than just trading opportunities; it also allows for the formation of a valuable Forex IB partnership through an introductory broker program. Understanding the workings of IBs is crucial for traders and investors in today’s intricate financial landscape.

This article will explore how IBs work and answer the question, “How much do introducing brokers make?”

Key Takeaways

- A Forex introducing broker is a third-party entity that assists brokers in attracting and acquiring new clients.

- IBs earn money through commissions.

- To become an IB partner, collaborate with a regulated broker and develop an online presence.

How IBs Work

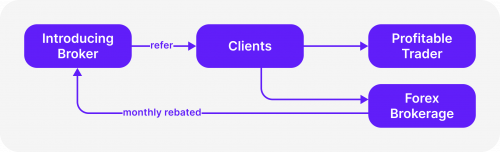

Introducing Broker (IB) in Forex is a customer-oriented business model in which an individual or company refers clients to an FX broker and earns a commission on the generated trading volume. IBs are a third party that helps brokers attract and acquire new clients by leveraging their expertise, networks, and marketing strategies.

An FX IB refers clients to a clearing broker-dealer, who receives rebates for any Forex trades executed by the referred clients. IBs aim to provide traders with an enhanced trading experience and trading tips, guiding them through complex financial markets. They answer client queries and provide educational trading materials, leading to increased confidence and trading with the broker.

IBs can leverage their industry networks, including fellow traders, investors, financial professionals, and influencers, to refer potential clients to their broker. They can also collaborate with the partner broker by creating joint marketing initiatives, such as educational content creation, webinars, or seminars.

How Do Introducing Brokers Make Money?

IBs can act as brokers or work directly with clients to close deals. Introducing brokers earn a percentage of the broker’s commission for each trade their referred clients make. The more clients and trading operations completed, the more commission the IB partner receives. There is no fixed commission rate, and the income volume grows with no limit.

IBs also offer personalised services, such as customer support, trading advice, and investment education, to foster a closer relationship with traders and investors. As independent third parties, the more clients they refer and the more trades they make, the more commissions and rebates they can earn.

Brokers can also set performance targets and combine fixed and variable commissions to attract more IBs for long-term partnerships. IBs can offer their clients their earned commissions to acquire and retain potential traders.

Types of IB Commissions

Introducing Forex brokers earn commissions based on the trading activity of their referred clients, typically a percentage of the spreads or transaction fees. These commissions serve as compensation for their services and can vary depending on the agreements between the introducing broker and the brokerage firm.

Two common structures of a Forex IB commision are rebates and Cost Per Acquisition (CPA). Rebates are calculated based on the volume of trades executed by the referred client, with the IB receiving a refund based on the volume of trades or a portion of the spread charged by the broker. The broker pays the rebates to the IB, typically on a daily basis, either in cash or credits to a trading account.

CPA differs from the rebate model, focusing on client acquisition rather than trading volume. The IB refers potential clients to the broker companies using various methods, such as networking or direct referrals, to encourage them to sign up and start trading with the broker. Qualifying clients must meet minimum deposit, trading activity, and account verification criteria set by the broker. Once a client meets these criteria, the IB receives a one-time payment, usually a fixed rate, agreed upon in the initial agreement between the IB and the broker.

Introducing broker commission rates can range from a few dollars per lot to significant percentages of the trading spreads. Traders must understand the commission structure offered by the introducing broker and evaluate its fairness and competitiveness within the industry.

Higher commission rates may reduce profitability, especially for high-frequency traders or those with large trading volumes. When selecting an introducing broker, traders should consider the quality of their services and the commission structure in place.

How Much Do Introducing Brokers Make?

The amount earned depends on factors like the broker’s commission structure, trading volume, and marketing efforts.

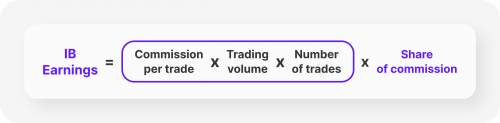

The earnings of an IB Forex can be calculated using the formula:

The IB Forex would earn commissions if the broker offers a 50% share of the spread and refers a client trading ten lots per month with a one pip spread.

IBs can earn passive income through referrals, which are clients who stay with the broker for years and open multiple positions. Brokers can pay up to 60% of the spread (pip) when clients take a position, allowing partners to earn up to $60,000 per month.

How to Become an IB

Becoming an IB requires careful research, partnering with a regulated broker, and developing an online presence.

To work as an Introducing broker partner in the European Union, there is no requirement for special certification, but other countries like South Africa, Australia, and the United States require some certification.

Finding the right broker to partner with requires significant research, including ensuring the broker is regulated, offering a wide variety of trading instruments, having mobile trading apps, offering demo accounts or trading tutorials, and providing marketing assistance. It is essential to partner with a reputable broker with supervision from a regulatory agency to maintain client satisfaction and protect your reputation.

- When making a deal with a brokerage, consider the rate of commission per trade, the perks offered, and whether you prefer working with a few clients per day or building up a large number of commissions over numerous clients. Consider the brokerage’s flexibility with commission types and the perks they offer.

- Finding clients and referrals and developing your online presence is crucial for earning high commissions as a successful introducing broker.

- Also, create a unique identity that portrays you as a credible financial commentator.

- Building on your success is crucial for introducing brokers, especially in the environment of internet reviews where reputation is everything. If clients are pleased and see significant returns on their investments, the brokerage firms you are partnering with will be pleased with you.

- Building on your success and focusing on quality over quantity will ensure your success and the success of your introducing broker partners.

Bottom Line

Forex IBs are crucial for traders to navigate the market. They facilitate client acquisition, offer specialised knowledge and trading education, and streamline account management. They can enhance trading experiences and potentially lead to cost savings.

An IB’s earnings rely on factors such as their commission structure, trading volume, and advertising efforts. IB partners can increase their earnings by acquiring numerous clients who engage in high levels of trading activity. It’s vital to choose a broker that has attractive commission rates and a powerful trading platform. By implementing well-thought-out strategies, IB Forex has the potential to generate significant earnings through the acquisition of new clientele.